How do banks calculate home loan affordability?

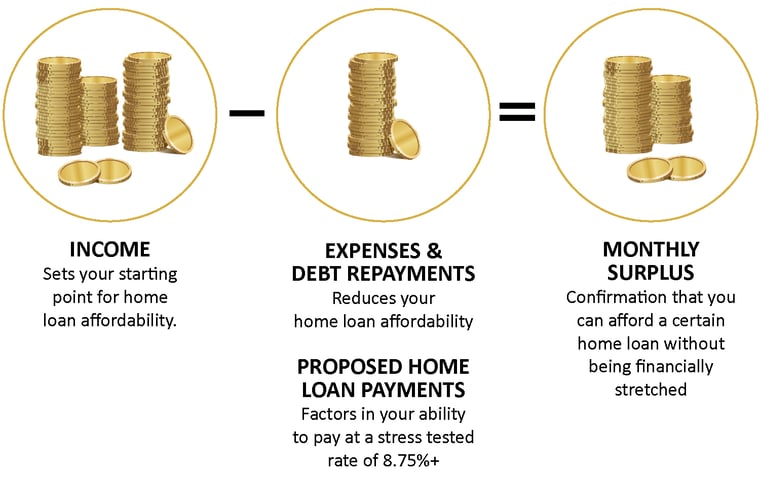

When reviewing a home loan application, banks consider a variety of factors to calculate affordability. However, all factors considered, it can be summarized into this simplified equation:

So, let’s look at these 4 components in more detail to understand what you can do to put your best foot forward when applying for a home loan, and identify any hurdles you may need to overcome.

1. Income

Income is the first factor in determining loan affordability. When assessing a borrower's income, banks typically consider:

- Stability of Income: Lenders prefer borrowers with stable and consistent income sources. They may look at the length of employment or self-employment, as well as the track record of income stability. This helps ensure that the borrower has a reliable source of income to meet their loan obligations.

- Gross Income: Lenders consider a borrower's gross income, which is the total income earned before any deductions. This includes wages, salaries, bonuses, commissions, and other sources of income. Gross income provides an overview of the borrower's earning capacity.

- Other Sources of Income: Besides primary employment income, lenders may also consider other sources of income such as Child Support and Working for Families. These additional income sources can contribute to the borrower's overall affordability.

2. Expenses

Banks consider the borrower's current regular, ongoing, and realistic living expenses. These factors help evaluate the borrower's ability to meet their financial commitments. Expenses include:

- Utilities (power, gas, water, internet, phone)

- Vehicle running costs (WOF, registration, petrol)

- Childcare

- Clothing

- Food and groceries

- Medical costs

Although you don’t need to include rent payments, the affordability calculation does factor in recurring home-ownership expenses such as:

- Insurance premiums

- Rates

![]() Focus on reducing your current expenses, and what you can remove.

Focus on reducing your current expenses, and what you can remove.

3. Debt

Debt significantly reduces your affordability for a home loan. Lenders will calculate your Debt-to-Income Ratio (DTI), which compares the borrower's total monthly debt payments to their gross monthly income. It helps determine if the borrower has sufficient income to cover their existing obligations as well as the new loan payment.

Banks also review a borrower's credit history, including credit scores and payment patterns, to assess their creditworthiness. A strong credit history demonstrates responsible borrowing behaviour and may increase affordability.

When banks evaluate your eligibility for a mortgage, they consider all existing debt obligations such as:

- Credit cards/Store cards/Buy Now Pay Later/Overdrafts: Even though you may not currently owe anything on your cards, the affordability calculation will still take into account your ability to make the monthly minimum payment on all of the card limits you have available. As a guide, $10,000 debt can reduce your lending options by $50,000!

- Student Loans: Your monthly student loan repayment is automatically deducted from your income, thus reducing the amount of money you have to service a home loan.

![]() Ideally, before applying for a home loan you would pay off all debt and close all cards. This would put you in the best position for the affordability calculation. Alternatively, consider reducing your credit card limits. If you have debt owing on cards, ensure you pay the amount owing each month to avoid interest. Note, you may also be able to include a condition on your home loan application that you will reduce the card limit, or pay it off and close the card.

Ideally, before applying for a home loan you would pay off all debt and close all cards. This would put you in the best position for the affordability calculation. Alternatively, consider reducing your credit card limits. If you have debt owing on cards, ensure you pay the amount owing each month to avoid interest. Note, you may also be able to include a condition on your home loan application that you will reduce the card limit, or pay it off and close the card.

4. Proposed Home Loan Repayments

The final part of the affordability calculation is to confirm you’re able to afford the home loan repayments. This is done via a debt servicing test to assess whether your financial situation would stand up to changes in situation during the term of your home loan. This could be increased home loan rates, a change in employment, or something else that could impact your ability to maintain your loan payments.

To calculate your proposed home loan repayments, the debt servicing test uses a calculation of 2% above the current interest rates. This means that you, as a borrower, need to prove that you can afford to borrow at that higher interest rate.

For more information on the importance of debt servicing when applying for your first home, read our blog, What is Debt Servicing and how does it affect your approval chances?

Speak to an Advisor

Before applying for a home loan, we suggest speaking to an advisor about what your affordability is. We can also help you identify any potential hurdles.