Interest Rates 2023 … the effect on first-home buyers

Whether you’re a first home buyer or already a property owner, we’ve all been nervously watching interest rates continue to rise through 2023. And now with last week’s OCR rise of another 50 basis points … if only we had a crystal ball to know the impact this is going to have on home loan interest rates going forward, and whether it’s a good time for first-home buyers to dive into the property market.

This article was written April 2023.

Why have interest rates continued to rise?

With the recent mix of low interest rates, government spending, and a tight labour market, this has sent inflation soaring to new highs. In fact, inflation is the highest it’s ever been for over 30 years! And then our economy has been impacted by pandemics, wars, and numerous natural disasters.

In an attempt to curb inflation, the Reserve Bank of New Zealand has continually increased the OCR. Raising it from 0.25% in late 2021, to the current 5.25% … and it’s predicted to be lifted again.

While the OCR is only one factor that determines bank lending rates, it’s a very important one. Floating mortgage rates and the OCR usually move very closely together, however, it’s the bank’s predictions of future OCR decisions that cause fixed mortgage rates to go up or down.

With higher interest rates, but lower house prices, what impact has this had on first-home buyers?

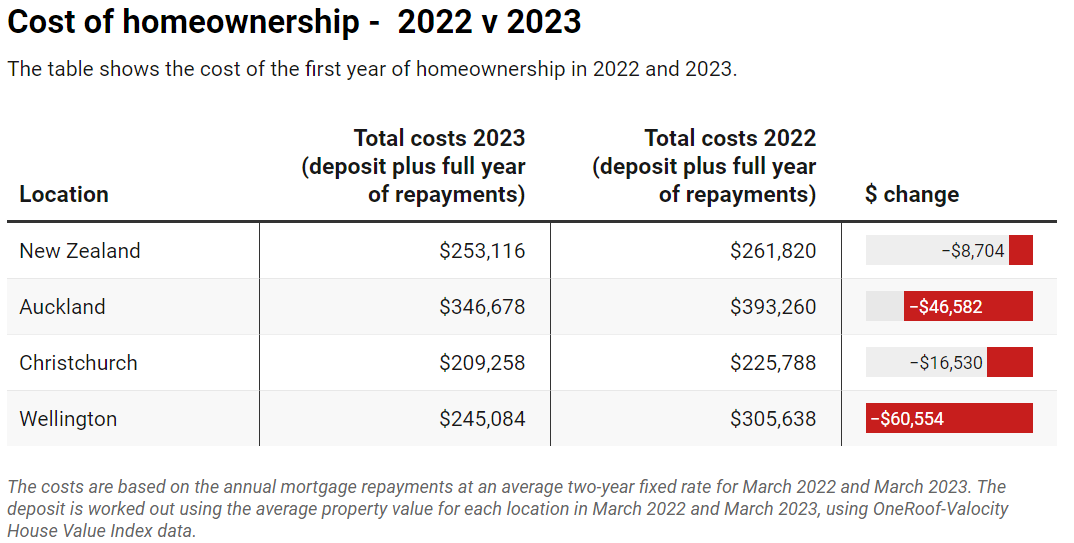

Due to property prices decreasing, with the nationwide average property value falling 11.5% in the last 12 months, home buyers now require a smaller deposit.

As reported by OneRoof: Rates v price falls: How much will your first year of homeownership cost? “In Auckland, a 20% deposit last year, based on the city’s average property value at the time, would have been a high $312,000. Now, a 20% deposit in the city would sit at $266,000.”

All good news so far … but what about the rise in interest rates, and therefore my mortgage repayments?

Despite the rise in interest rates, Cost of Homeownership (2022 v 2023) has decreased.

How will interest rates affect the Debt Servicing Test in 2023?

The Debt Servicing Test (DST) is a test used by lenders to determine whether a borrower can afford to service a loan. The DST rate is the interest rate that is used in this test. It is set by the Reserve Bank of New Zealand and is based on the average interest rate for new mortgage lending by registered banks.

The DST rate is used to calculate whether a borrower can afford to make the payments on a new loan, based on their income, expenses, and other financial obligations. If the borrower's income is insufficient to cover the loan repayments at the DST rate, then the lender may decline the loan or offer a smaller loan amount.

It's worth noting that the DST rate is not the same as the interest rate that a borrower will pay on their loan. The actual interest rate will depend on factors such as the borrower's creditworthiness, the size and term of the loan, and market conditions at the time the loan is approved.

As at April 2023, the main banks are using a DST rate of around 8.5% plus This means you as a borrower need to prove that you can afford to borrow at that interest rate even though the current rates are lower in the 6’s.

Check out our blog on What Is Debt Servicing And How Does It Affect Your Approval Chances? to understand the importance of debt servicing when applying for your first home loan, and what you can do to improve your approval chances.

How optimistic are first-home buyers?

Despite rising interest rates, first-home buyers appear to be remaining optimistic in their dream of buying a home. According to Tony Alexander: Seven reasons why first-home buyers are back in the market, this is due to:

-

“Fears of shockingly higher interest rates are rapidly disappearing.

-

For all the talk of recession, hardly anyone is being laid off and plenty of jobs are on offer. Feelings of job security are strong.

-

Banks are not meeting their mortgage sales targets as real estate turnover is running 35 per cent down from a year ago. They are responding by easing up their lending criteria in a further step away from the credit crunch the Reserve Bank and Government imposed late in 2021.

-

The stock of property to choose from is the highest since late 2015.

-

Competition at auctions and open homes from other buyers, including investors, is minimal.

-

House prices have fallen some 16.2% from their peaks, while incomes have risen over 8%.

-

Rental shortages continue and could be worsening, while rents continue to rise even as house prices fall. The push to buy rather than continue renting grows as each month goes by.”

What are the predictions for New Zealand’s housing market and interest rates in 2023?

Tony Alexander, Independent Economist and Speaker

Tony believes that the fact that mortgage rates have already peaked will be relevant for the housing market. “It's probably going to encourage a few more first-home buyers to come forward, maybe not the investors as yet. I think that's still a bit further down the road, down the track.”

That doesn’t, on its own, mean that a revival in house prices is imminent. Prices still have a way further to fall, he says, adding: “I think they're getting near the bottom.”

Mary Jo Vergara, Kiwibank Senior Economist

Mary Jo agrees that the bottom of the market is near. “House prices are down around 15 to 16% from the November 2021 peak. We think they'll fall a little bit further in the coming months, down to a trough decline of around 20 to 21%. But they'll start to rise later this year.”

Infometrics

Infometrics is forecasting the official cash rate, currently at 4.25% (as at Feb 2023), to rise to 5.75% by June, taking mortgage rates above 7% for the first time since 2008.

DISCLAIMER: This information is not intended as financial advice or a recommendation. It does not take into account your individual needs or financial situation. We recommend you always seek independent legal and financial advice.