The Key Benefit Of A YouOwn Co-Ownership Home Loan

Low Deposit Home Loan Versus Co-Ownership Home Loan With YouOwn

The challenge of putting together a deposit for your first home is a daunting one. With the house prices where they are it can seem like an impossible task to get to a target of around 20%.

This is where first home buyers start to look at their options for obtaining a home loan. Be it a low deposit home loan, teaming up with friends or getting a gift from parents.

Low deposit loans can help lower the deposit hurdle

We've spoken about Low Deposit Loans before here as a good option for first home buyers. A low deposit loan could mean you are ready to buy your first home with less than the ideal 20% deposit.

However, there are some downsides. Firstly, Banks don't offer their special rates for low deposit home loans, so you can expect higher interest costs including a low equity premium on top of the standard interest rate. Secondly, because the Banks are only allowed to have a small percentage of their mortgages as low deposit, they are harder to get. Finally, there is often mortgage insurance due to it being a higher risk loan.

So what other option is there?

While a low deposit loan is a good option to help stepladder up to a regular mortgage, it is not the only option available to first home buyers with small deposits. The First Home Buyers Club has been working with YouOwn to help several first home buyer families into their first home.

Co-Ownership with YouOwn in simple terms is a way of lowering the deposit required for a home to 5% of a property’s value. Your deposit is topped up by an investment by YouOwn to enable you to purchase the property.

The Co-Ownership initiative is a similar step ladder to a low deposit loan with one key advantage - lower interest costs.

Comparing Low Deposit Loans to Co-Ownership

To explain the cost comparison of a low deposit home loan versus a co-ownership home loan, here is a basic example of buying a house.

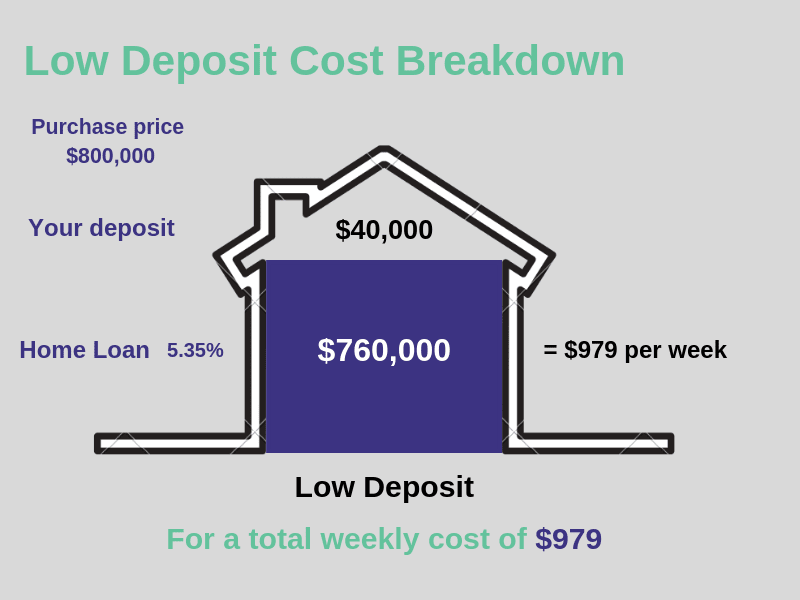

Low Deposit Home Loan - Cost Breakdown

You are looking to buy a 3 bedroom home in Auckland. For this example, we'll say that will cost $800,000.

The numbers are as follows:

- You have a 5% deposit of $40,000.

- Making your home loan $760,000.

- The interest rate due to it being a low deposit loan is 5.35% (includes a low-equity interest rate premium)

- For a total weekly cost of $979

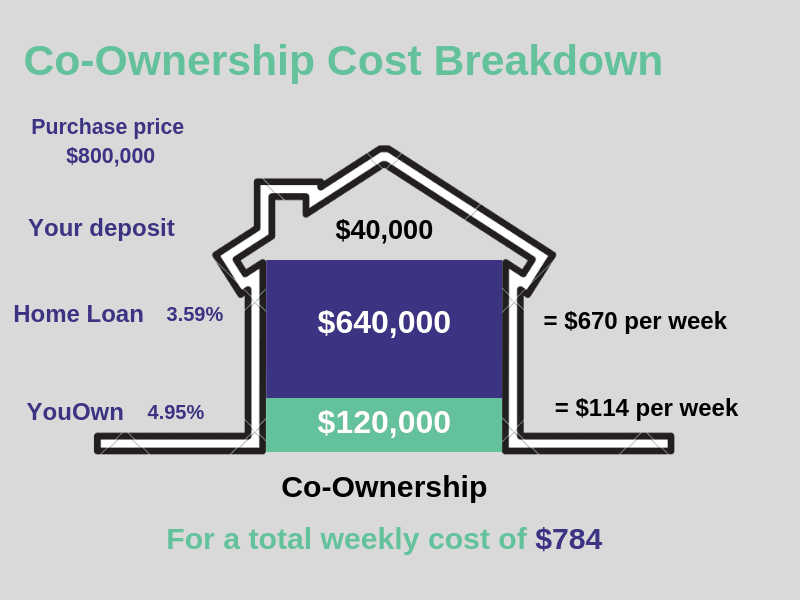

Co-Ownership Home Loan - Cost Breakdown

Again you are looking to buy a 3 bedroom home in Auckland for $800,000.

The numbers are as follows:

- You have a 5% deposit of $40,000.

- YouOwn contributes $120,000 with an equity charge of 4.95% fixed for 5 years, at a weekly cost of $114.

- Because you have partnered with YouOwn you are able to access special bank interest rates, currently 3.59% for a weekly cost of $670.

- These combined makes a total weekly cost of $784

So as you can see, the option of a co-ownership home loan has significant cost benefits, potentially saving you up to $50,000 in interest costs over 5 years.

The reason your interest costs are lower is that the combined rates for a Co-Ownership home loan is 3.8% compared to the low deposit rate of 5.35%.

Interested in learning more about Co-Ownership?

YouOwn is a shared equity solution to help first home buyers own their own home.

In basic terms it is a way of lowering the deposit required for a home to 5% of a property’s value. Your deposit is topped up by an investment by YouOwn to enable you to purchase the property.

TO LEARN MORE ABOUT YOUOWN AND HOW IT CAN HELP YOU BUY YOUR FIRST HOME, VISIT HERE

Criteria For Co-Ownership Housing:

- Combined household income of $110,000+

- Deposit from savings and/or KiwiSaver of at least 5% of the purchase price.

- Be a New Zealand Citizen or Permanent Resident.

- Have a clean credit history.

- Little or no debt (less than $15,000)

- Comfortable with repayments on a mortgage of $500,000 or greater (we can help you determine if you are able to should you decide to proceed with the opportunity).

- Be buying the property to live in.

If you’re interested in using YouOwn co-ownership initiative to purchase your first home, please ensure you meet the criteria above and apply at the page linked below: